Eying Opportunities in Southeast Asia, THL Enters the Philippine and Vietnam

Established in 2016, SJ Conso has successfully introduced a

range of excellent THL-represented brands to the Philippine

retail market.

Established in 2016, SJ Conso has successfully introduced a

range of excellent THL-represented brands to the Philippine

retail market.

Southeast Asia is emerging as an important engine of future global economic growth, one with high-potential retail markets driven by booming economies. THL is ambitiously positioning to tap the huge business opportunities in this region. The company understands that success is built on hard work, but already it is making headway in the Philippines and Vietnam.

SJ Conso chalked up 20-fold growth in 2018 and is shooting for another five-fold gain in 2019." ~ SJ Conso CEO Jimmy Yeh

SJ Conso CEO Jimmy Yeh

SJ Conso CEO Jimmy Yeh

After two years of planning and preparation, THL realized its ambition to enter the Philippines with the establishment of SJ Conso Inc. at the end of 2016 with a mission to bring the high-quality brands represented by THL to consumers in the Philippines.

By the end of 2018, SJ Conso had formed a small team of 10 partners. Though young, the company sees unlimited development potential ahead.

SJ Conso ultimately seeks to "copy and paste" THL's model to the Philippine market. First, though, it needs to become "grounded" in the local market by understanding local customs in the Philippines and further analyzing the needs of local consumers. The company also needs a marketing strategy that can accurately connect with consumers and cultivate brand identity.

SJ Conso has also developed a pragmatic and sound development strategy to face the challenges presented by the unique channel ecology in the Philippines. Company CEO Jimmy Yeh says that in the Philippines less than 50% of the fast-selling consumer goods (FSCGs) are sold through modern chain stores, compared to more than 90% in Taiwan. Modern chain stores are capturing a growing ratio of FSCG sales in the Philippines, but they are unlikely to replace traditional grocery stores in the next ten years. In 2019, SJ Conso will therefore continue to develop its snack food business. The company currently represents the I-Mei and Hunya snack brands and will successively negotiate with Chinese food companies to bring their products to traditional grocery store channels.

Yeh also notes that the Philippines is four times as populous as Taiwan and eight times larger, with more than 7,000 small islands. SJ Conso depends on support from an extensive network of dealer partners to navigate the highly complex channel operations in this market.

At the same time, drug store chains are growing in the Philippines. Watsons is increasing its store count in the Philippines by 20% a year. Yeh plans to introduce more in the beauty and health care product to drive sales higher, drawing on his extensive business and management experience in this sector.

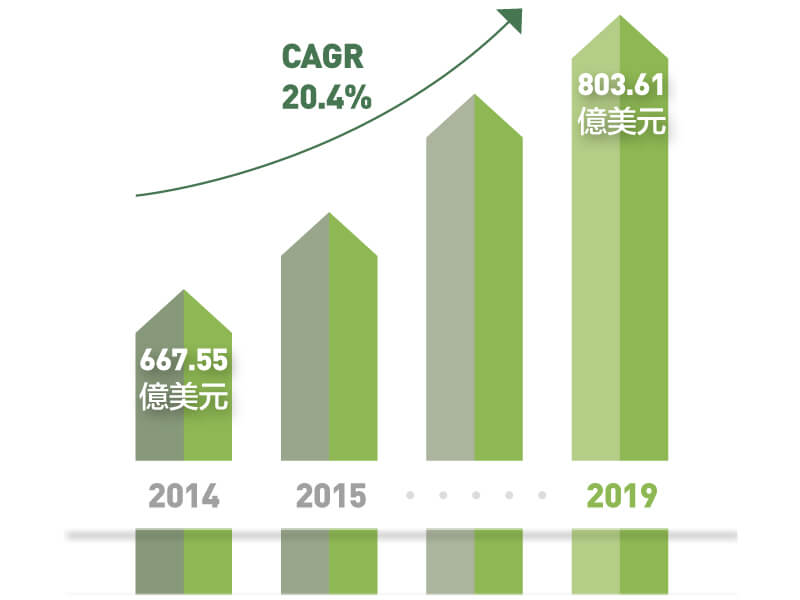

According to data from market researcher Euromonitor, the

overall retail sales value in the Philippines reached

US$66.755 billion in 2014 and is estimated to grow at a

compound annual growth rate (CAGR) of 20.4% to reach

US$80.361 billion in 2019. Physical channels account for

97.66% of this total, leaving only 2.34% of the market to

non-physical channels, consisting mainly of coin-operated

vending machines, TV shopping, direct marketing, and

online/mobile shopping. However, sales through such channels

have grown at a CAGR of 46.5% over the past five years.

(Source: Euromonitor)

According to data from market researcher Euromonitor, the

overall retail sales value in the Philippines reached

US$66.755 billion in 2014 and is estimated to grow at a

compound annual growth rate (CAGR) of 20.4% to reach

US$80.361 billion in 2019. Physical channels account for

97.66% of this total, leaving only 2.34% of the market to

non-physical channels, consisting mainly of coin-operated

vending machines, TV shopping, direct marketing, and

online/mobile shopping. However, sales through such channels

have grown at a CAGR of 46.5% over the past five years.

(Source: Euromonitor)

Seeing strong product potential for Vietnamese vegetables,

THL established its Vietnam subsidiary Taiwan Hsin Chen

Enterprise to import frozen vegetables from Vietnam to

Taiwan.

Seeing strong product potential for Vietnamese vegetables,

THL established its Vietnam subsidiary Taiwan Hsin Chen

Enterprise to import frozen vegetables from Vietnam to

Taiwan.

THL and Thuy Hong partnered to produce and import to Taiwan

the specialty green onion sauce packs used in Jinbo

Selection's SOul Spicy Noodles, picked by Le Cordon Bleu as

Asia's second-best instant spicy noodles.

THL and Thuy Hong partnered to produce and import to Taiwan

the specialty green onion sauce packs used in Jinbo

Selection's SOul Spicy Noodles, picked by Le Cordon Bleu as

Asia's second-best instant spicy noodles.

THL is cooperating closely with Vietnamese agricultural

food tech company Thuy Hong with eyes on the Southeast Asian

market.

THL is cooperating closely with Vietnamese agricultural

food tech company Thuy Hong with eyes on the Southeast Asian

market.

"Taiwan Hsin Chen will design products to sell through CVS channels, starting with chestnut-flavored sweet potatoes."Thuy Hong Vice President Lin Chen-shan.

Beyond the Philippines, THL is entering another Southeast Asian market through cooperation with Vietnamese agricultural food tech company Thuy Hong Enterprise Co., Ltd.

Thuy Hong's Vietnam plant is located in an area with the ideal geography, climate, soil, and elevation conditions for vegetable farming. Anticipating strong market potential for Vietnamese vegetables, THL established Taiwan Hsin Chen Enterprise in 2018. The Vietnam subsidiary has partnered with Thuy Hong to plans to expand this collaboration with new product lines in the future.

Thuy Hong has more than 15 years experience in developing frozen and dried vegetable production technology. The company currently produces nearly 30 items, mainly for export to Japan, China, Taiwan, Singapore, and other areas. One of the company's most distinctive products, chestnut flavored frozen sweet potatoes, has gained popularity among consumers in a number of regional markets.

Thuy Hong Vice President Lin Chen-shan says that Thuy Hong previously focused on developing frozen and dried vegetable product lines. In 2019, the company plans to invest NT$10 million in a new food prep area and release low-temperature, vacuum packed ready-to-eat fried foods. The company will start with chestnut flavor sweet potatoes and aims to sell this product through CVS channels in Taiwan. THL plans to create new product lines in the future with Thuy Hong's solid product support.